Control Network Newsletter

What is your Country of Origin (CoO)?

Now that the U.S. election has been decided, the issue of tariffs has again been highlighted. For some companies, tariffs offer protection, and to others they are just another tax that shrinks margins unless you have the luxury of passing the expense onto your customers. We are receiving more inquiries as to where our products are made and if we comply with Made in USA. You would think this is an easy question to answer, but it is not.

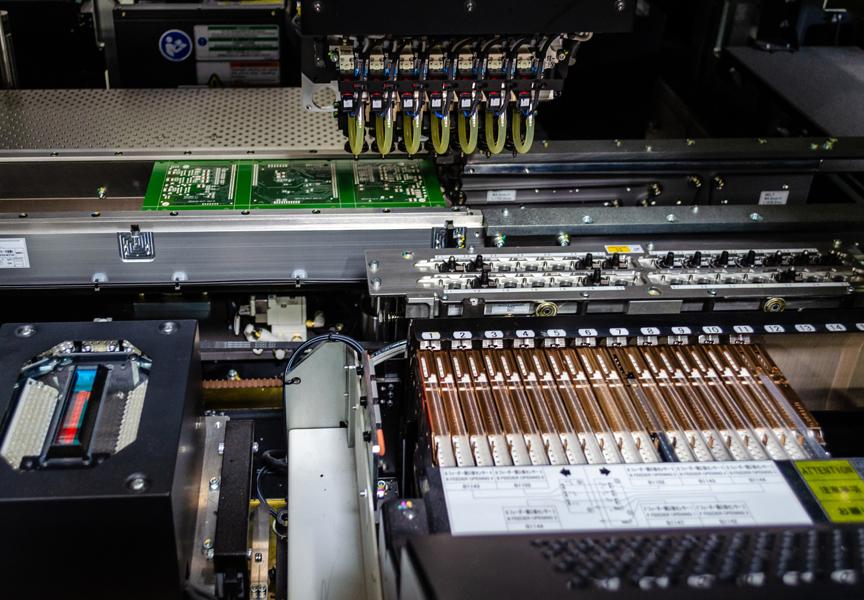

Rules of Origin determine the Country of Origin which appears on the product's label. With fair trade agreements, such as United States-Mexico-Canada Agreement (USMCA), the rules of origin are written into the agreement. Without a preferential trade agreement, we must follow rulings by Customs and Border Protection (CBP). If all the components of the finished good are domestically sourced and all processing occurred in the United States, the country of origin is indeed the United States. With electronics manufacturing where almost all your passive components are worldwide sourced, this is difficult to achieve. However, the CBP allows for "tariff shifting" where the country of origin is determined by the last location where the product was substantially transformed into a different article of commerce from those of its components. In prior CBP rulings, the process of creating a printed circuit board assembly represents a substantial transformation. If this transformation occurred in Downers Grove, IL, then the country of origin is the United States. In almost all situations, we comply with the tariff shift regulations in the USMCA and for those qualifying products, we say Made in USA.

Contemporary Controls is well-suited to support our customers with any upcoming transition requirements. To learn more about our captive electronics manufacturing capabilities and our Made in USA claims, go to our USMCA page.